Earning air miles is not all about flying. You can earn air miles from using your credit card too. You will earn miles just for signing up (= sign-up bonus) followed by miles calculated on how much you use your card. The amount varies from 1 mile to 2 miles per euro spent. I will guide you through the few possibilities here in Belgium.

Brussels Airlines American Express Credit cards

With the card listed above you can earn miles with Miles & More to use for flights. American Express (Amex) has two cards offered:

- Brussels Airlines Preferred American Express

- Brussels Airlines Premium American Express

Both are very similar, besides the Premium one costs you a little more annually to earn more miles per euro. There is also a current promotion offering 5.000 bonus miles when registering for the Premium American Express.

As you can see both cards carry an annual cost charged monthly. The benefits for the Premium card are:

- Travel accident insurance, purchase insurance and baggage insurance

- Purchase protection

- Welcome bonus of 5.000 miles

- 2 miles per euro spent on Brussels Airlines

- 1.5 miles per euro spent everywhere else

- Annual bonus of 10.000 miles when reaching 20K spending threshold

Taking into account the value of Miles&More miles, which is estimated at around 0,01 euro per mile, you will make a fictional profit from the welcome bonus the first year and afterwards you will need a spending of 10K euro with the card per year to “break-even”. The ultimate sweet spot is 20K euro spend, because it will boost your “Return of Investment” (ROI) extremely hard, as you will earn an annual bonus of 10.000 miles.

Business class starter on Brussels Airlines – Long haul flight

The best way to maximize the value of your miles is by spending them on business and/or first class flights. Loyalty programs will advertise to spend your miles on shopping, hotel bookings or other things but the use of your miles are never as valuable as booking business class flights.

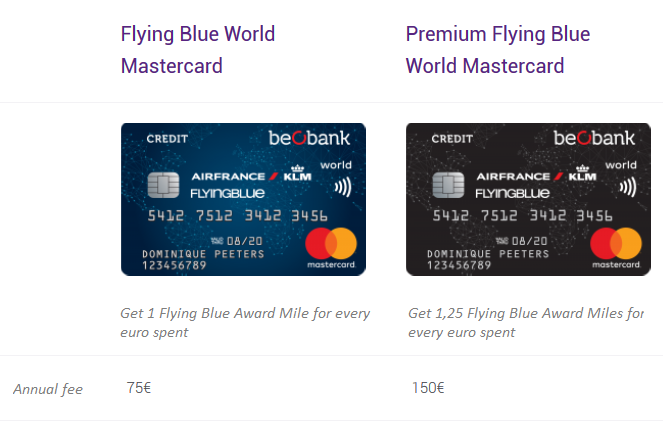

Beobank Flying Blue Mastercards

Flying Blue is a frequent flyer program for the alliance Skyteam with airlines such as KLM, Air France, Delta and a few others. With the Flying Blue cards you can save air miles that can be used on Skyteam partners.

Sign-up bonus for Flying Blue World MasterCard is 3.500 miles whereas the Premium card gets you 5.000 miles. You will get 1.25 miles per euro spent in Flying Blue miles with the Premium card.

Business class lunch on ITA Airways (SkyTeam member) – Intra-European flight

The card offers more insurance options than the Amex option and therefore gives you more protection on the road: travel insurance and cancellation options, travel assistance, travel acident insurrance and car rental insurance (see here).

Another advantage compared to the Amex is that MasterCard is usually accepted everywhere.

Conclusion:

Beobank cards are handy if you want to be able to use the card everywhere, as MasterCard is widely accepted in Belgium. You will also get more insurance than Amex. However, the sign-up bonus is fairly low with Beobank while the annual costs are similar to the Amex cards.

If we make the calculation, considering the value of 1 Flying Blue mile as 0,01 euro per mile, you’ll need an annual spent with your Beobank card of 12.000 euro to have a fictional break-even. It is therefore easier to get the most value out of your card with Amex. The Beobank card is much less interesting because the sign-up bonus is very low and the annual costs are very similar to the Amex option.